Fed chair, Janet Yellen, recently made the following statement before the Financial Services Committee :

In December, the Committee judged that the cumulative progress toward maximum employment and the improvement in the outlook for labor market conditions warranted a modest reduction in the pace of purchases, from $45 billion to $40 billion per month of longer-term Treasury securities and from $40 billion to $35 billion per month of agency mortgage-backed securities. At its January meeting, the Committee decided to make additional reductions of the same magnitude. If incoming information broadly supports the Committee’s expectation of ongoing improvement in labor market conditions and inflation moving back toward its longer-run objective, the Committee will likely reduce the pace of asset purchases in further measured steps at future meetings.

Janet Yellen, Federal Reserve Chair

Her statement indicates that the current tapering of bond purchases will continue.

What It Means For You

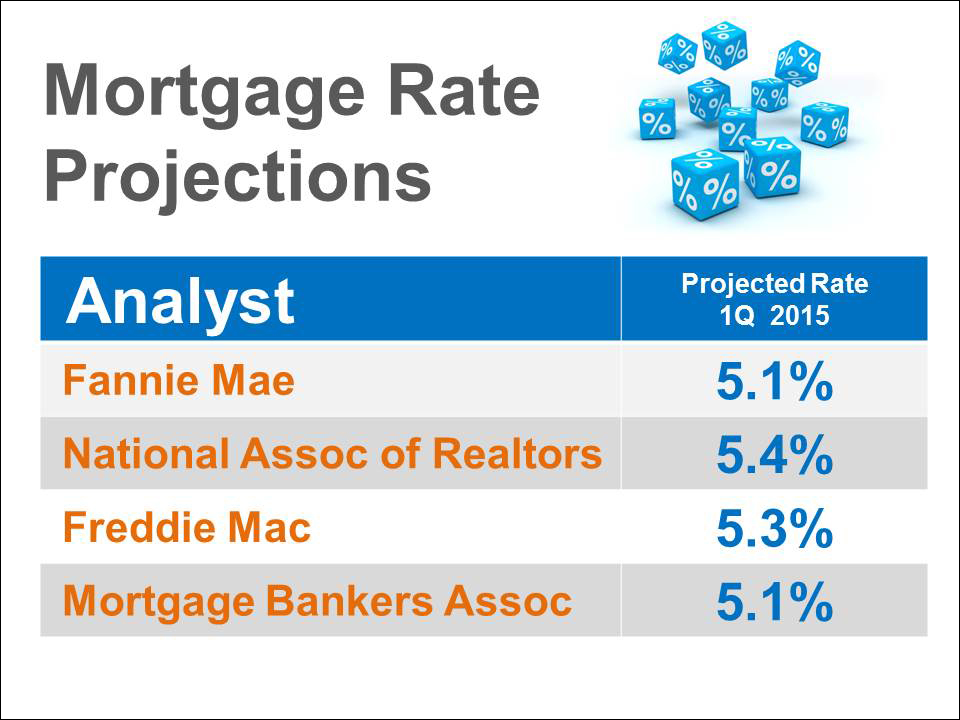

Mortgage rates are projected to rise.

Rates in 2015

In view of this trend, it’s probably a good time to act now. Contact us so that we can help you stay ahead of the curve as much as possible. Our experience will work for you.

![Read more about the article How to Be a Competitive Buyer in Today’s Housing Market [INFOGRAPHIC]](https://skyrisere.com/listings/wp-content/uploads/2021/03/D742693C-07B3-4727-A3DD-64F594EDE478-300x300.jpeg)